Our Gold Card Visa Diaries

Table of ContentsRumored Buzz on Gold Card VisaGold Card Visa for BeginnersIndicators on Gold Card Visa You Need To KnowGold Card Visa - TruthsAll About Gold Card VisaGold Card Visa Things To Know Before You Get This

For the United States Gold Card to end up being a regulation, the proposal has to pass your house of Representatives and the Senate to safeguard bipartisan assistance, which can be challenging offered its debatable nature. Furthermore, agencies like the US Citizenship and Immigration Provider (USCIS) and the US Division of Homeland Safety (DHS) will need to resolve issues regarding nationwide safety and security, identity checks, cash laundering, and the ethical ramifications of the Gold Card visa holder. Gold Card Visa.United States Embassy and Consulates had actually issued a lot more than one million non-immigrant visas, an almost 26 percent boost from 2023. This development in international involvement could create an appealing environment for the United States Gold Card visa in the future.

"You do not need to have $5 million in your bank account to develop a successful business in America. Just check out Sergey Brin, Sundar Pichai, or Satya Nadella," Khanna informed Newsweek in a declaration Wednesday. The "gold card" news came in the middle of a flurry of activities by the head of state to limit other migration paths for those that can not pay for the high cost.

Some Known Incorrect Statements About Gold Card Visa

Trump said gold cardholders would bring a great deal of financial investment and tax obligation income, while the Business principal said the collection of $5 million fees can help balance out the country's shortage. Migration plan specialists and lawyers quickly explained that the head of state does not have the power to produce new visa categories, or end the EB-5.

Thus far, there has actually been no main news published by the White Home or USCIS.

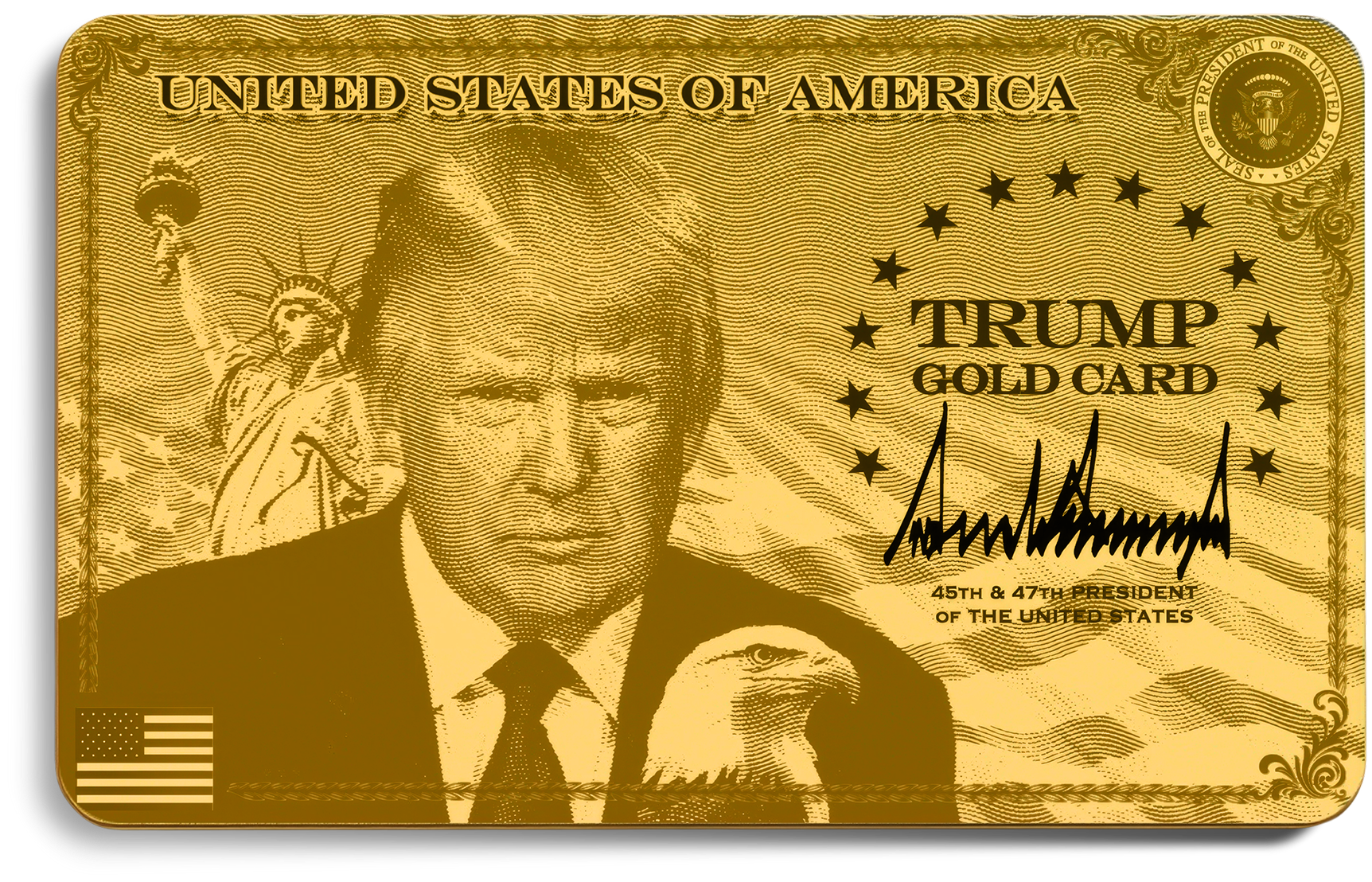

By: Hector A. Chichoni, Esq. Head of state Trump announced Tuesday, February 26, 2025, the management's plan to supply $5 million "gold cards," which will provide vetted people who pay $5 million, legal irreversible house in the U.S. Details on just how the procedure is going to function are not understood, however the President stated they have actually been believing for some time concerning this "gold card." In addition, the Head of state guaranteed the gold card plan would certainly be introduced in "2 weeks." Based just on President Trump's and U.S.

Not known Details About Gold Card Visa

Treasury Division, and would acquire LPR condition ("eco-friendly card" standing) in the united state. The "gold card" is a permit with unique opportunities and benefits. All environment-friendly card holders have a path to U.S. citizenship. The gold card will be a "fast lane" or "expedited handling" to get LPR condition in the united state

Nevertheless, it might be readily available to specific Russian citizens. Applicants may be expected to establish organizations, pay tax obligations (LPRs pay tax obligations to the U.S. based on worldwide earnings), produce tasks, etc. Nonetheless, no specifics have actually been given on whether energetic or easy investments will be enabled or needed. The new gold card would likely replace the EB-5 program, which was planned to promote the united state

Additional, the EB-5 program has actually obtained relentless problems of fraud and misuse regarding the program. The program would enable companies to "buy," additionally for $5 million, united state house, generally called a "permit," for high-skilled or highly informed employees, recommending it may replace some type of work visas. It is not yet clear whether the administration can end or alter the existing program EB-5 (or any one of the EB1-4 programs) without congressional approval.

Some Known Details About Gold Card Visa

The $5 million investment demand under the United state plan would navigate to this website also make the gold card one of the most expensive of such programs in the globe. The gold card comes at a time when the European Union is putting stress on participant states to take out or tighten up residency-by-investment programs, which can create housing price bubbles, marginal advantages to GDP, and increase the dangers of tax obligation evasion and corruption. It is probable that the present administration might be able to carry out the gold card strategy and even give for prompt handling of LPR condition for gold card candidates.

it has not been greater than 2 years since you finished. Outstanding pupils of international colleges might be approved a Golden visa for a period of 10 years without an enroller, gave that: The college is ranked amongst the finest 100 colleges worldwide according to the score system recognized by Ministry of Education The pupil's collective grade point average is not much less than 3.5 It has not been greater than 2 years considering that you graduated Graduation certificate is certified by the Ministry of Education and learning If you are a pioneer of humanitarian job, you might obtain a Golden visa for 10 years.

As part of the news, the Head of state said that owners of the card would be exempt from taxes on their abroad earnings. US taxpayers, including United States irreversible citizens, are typically subject to taxes on "all revenue from whatever source derived," that includes income gained both in the US and from foreign a knockout post resources.

Facts About Gold Card Visa Uncovered

source earnings and revenue effectively gotten in touch with U.S. trade or business" alone, if the brand-new card comes with the right to enter and reside in the United States, it would be a significant modification in United States tax obligation law to exempt those living below from tax of income outside the United States, one that would certainly require Congress' authorization.

As component of the statement, the Head of state said that holders of the card would be excluded from tax obligations on their abroad revenue. United States taxpayers, consisting of US permanent locals, are typically subject to tax on "all earnings from whatever source derived," which includes revenue earned both in the US and from international resources.

resource revenue discover this and income successfully gotten in touch with united state trade or business" alone, if the brand-new card features the right to enter and stay in the United States, it would be a significant modification in United States tax obligation regulation to excuse those living right here from taxation of earnings outside the US, one that would require Congress' approval

The standard minimum investment amount has increased to $1.8 million (from $1 million) to represent inflation. The minimum financial investment in a TEA has enhanced to $900,000 (from $500,000) to represent inflation. Future modifications will certainly also be linked to rising cost of living (per the Consumer Cost Index for All Urban Consumers, or CPI-U) and take place every 5 years.

An Unbiased View of Gold Card Visa

30, 2018, when it comes to Zhang v. USCIS, No. 15-cv-995, the United State Area Court for the District of Columbia certified a course that includes anyone that has a Kind I-526, Immigrant Request by Alien Investor, that was or will be rejected on the sole basis of investing financing profits that were not safeguarded by their own possessions.